A Lazy Accounting Method

Categories: [finance], [spreadsheets]

If you're like me, you're incredibly lazy but also want to be "rich" some day. The best way to get there is by accounting your income and expenses regularly. Here I'll relay a simple accounting strategy that I use in case it might help you.

TL, DR

Use Mint.com to collect and categorize your income and expenses. Review your expenses monthly. Copy your spending history to a spreadsheet periodically. Download your check images and bank statements annually. Keep digital copies of all important documents.

Banking Setup

TL, DR: Get several accounts to categorize transactions logically.

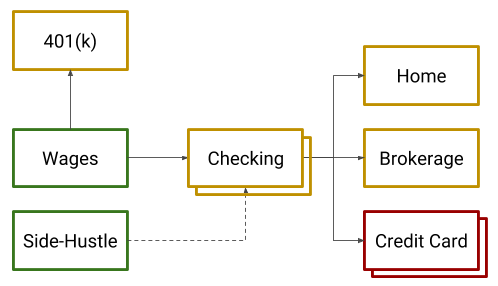

The first step is to have a banking setup that works for you. I use Charles Schwab because they have great customer service, a solid website, and a competitive fee schedule given what they offer. Make sure you have at least:

- A checking account for day-to-day spending.

- A credit card that you never carry a balance for.

- A 401(k) account if your employer offers one.

- A brokerage account for saving monthly excess cash.

Yes, you should have all three of these because they serve different purposes.

The checking account is for "broad strokes" transactions like collecting your wages, paying your mortgage, and writing checks. Try to insulate this account from smaller transactions like groceries or gas.

The credit card should exist as a buffer for your day-to-day transactions. Credit cards build your credit score, get you cash back or points, and oftentimes the provider offers special programs like extended warrenties on your purchases. Use this for buying coffee, fast food, airfare, etc.

After that, contribute as much as possible to your 401(k) if you have one. The tax benefits and retirement focus mean that if you max out this account and spend every other dollar you make during your career, you can still retire in a reasonably good financial position. I know people who are doing exactly this and I don't fault them for it.

Finally, the brokerage account is where you'll want to save any excess capital. This isn't necessarily for stocks either; there're lots of options in mutual funds, bonds, and so forth. This is a topic for another article, so I'll leave it to you to research.

If you run a business from home, have a lot of small deductible expenses, or own your own home, consider creating additional checking accounts with your bank. They're should be free and this helps keep related expenses clustered together for easier accounting. For example, I keep my home expenses in a separate checking account. I use a credit card mapped to that account whenever I spend money on the house. That helps me keep track of how much I spent without having to do a lot of categorization in the next step.

ASIDE: If you want to know how to allocate your funds, this finance flowchart is super useful..

Setup In Mint

TL, DR: Get Mint to consolidate and categorize your transactions.

Mint.com is like the really lightweight version of Intuit's QuickBooks software. It's ad supported so you don't have to pay for it, which is nice. The way it works is this: you provide your login credentials for your bank, credit cards, and lenders, and then Mint.com downloads and categorizes your transactions so you can track your spending.

I realize this feels like something a Privacy & Security Professional wouldn't sign up for. I trust this company and they deliver a lot of value in exchange for the personal information they collect.

If you want to go the extra mile, you can set up monthly budgets in Mint. It'll track your spending by category and you can set up alerts if you go over budget. This can be useful during quarterly reviews.

Monthly Work

TL, DR: Log in monthly to Mint and correct/classify transactions.

Every month, log in to your Mint.com account and categorize your transactions while they're still fresh in your mind. Most items get categorized well and you don't need to worry about them. Groceries and gas tend to be pretty bullet-proof in this regard.

Others can have inscrutible names or you might not remember why you shopped at a particular place, and that can have a bearing on the categorization. For example, you might shop at TJ Maxx but not remember whether you were there buying a birthday gift for a friend (Gift category) versus for some home decoration (Home Furnishings).

The other thing to do in Mint is to add tags to your transactions. You can make custom categories in Mint, which is useful for broad, unusual classes of transactions like Wedding or Broken Arm. But tags are finer-grained and good for "orthogonal" classifications like, say, your Etsy store. The category might still be Gas or Business Services but, because they're for your store, you can tag it with Etsy Business. Some default tags should be there and include Deductible for things that need to be declared on your tax return. But you can use these for anything, and you can add multiple to a single line item. So if you run multiple storefronts or have a website separate from the storefront, you can assign transactions to one, the other, or both.

This is very powerful! A good taxonomy makes searching and sorting later on much easier and lets you allocate expenses at tax time to save a bundle.

Quarterly Work

TL, DR: Download your data and make sure everything's going according to plan.

Each quarter, re-evaluate where you're spending money and how you're trending against your budgets. Are you over-spending? Increase your budgets or decrease your spending to keep on track with your financial goals. Did you start a new project that needs its own account? Now's a good time to set that up before those expenses get entrenched in the wrong account.

One thing I like to do is download all of my transactions and statement balances to a Google Sheets workbook so I can run my own analysis on it. This is a bit overboard, but it's a great way to build your own customized dashboards for tracking long-term financial health.

Mint data can be downloaded directly from the website, and contains all of your fine-grained transactions.

Your bank should provide you with statements which you can download to PDF and upload to Google Drive for long-term storage. You can copy the month-end balance and save it to a spreadsheet to track overall cashflows and net worth.

Annual Work

TL, DR: Close out the year, download any final items, and reflect on performance.

At the end of each year (preferably the first week of January) you should perform an annual wrap-up and close out the past year. There are several things to do here.

First, download any items you haven't already copied from your financial institutions:

- Statements - These aren't kept online forever, so download them for posterity.

- Check Images - Get images of every check you wrote and save 'em in case you get audited.

- Tax Documents - I know these come in Feb, but save them with the year they correspond to.

Next, double check that all of your major expenses during the year got the appropriate annotations and show up in the correct accounts. Does the year look normal? Your mortgage was paid each month and rental checks or dividends were paid properly? Now's the time to raise a stink if they weren't.

That's pretty much it. Keeping your accounting separate among a few, isolated accounts helps you keep your expenses clear and cuts down on complexity. Doing monthly, quarterly, and annual check-ins is a great way to keep on track with your financial goals and keep your records straight in the long term.

Good luck!